Lire cet article en français

Summer is coming up. It is about time to check what you really know about the techs that “might” replace you during your vacations.

I hear about “technology” all the time. All finance professionals around me seems to be very excited about it, and eager to take full advantage of it, or at the opposite, scared it might eventually make their job irrelevant.

But when I scrape just a little bit under the surface, for both of them, I realize that most of them often don’t really know much about it.

I don’t know much about it either. And this is why I constantly read and watch on various tech subjects in order keep up. This is hard and time consuming but I do think it is unavoidable, and that everyone should do it.

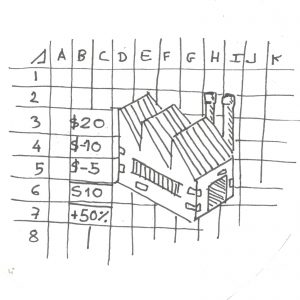

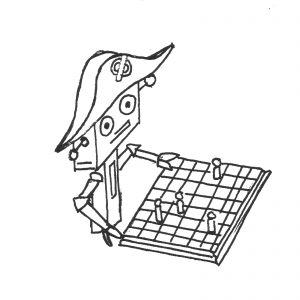

So here is a quick and modest ( I do not pretend to be an expert in those subjects ) little quiz that will check your “basic” knowledge about the 3 main “hot techs” of this spring in service driven industries : crypto & blockchain, artificial intelligence and quantum computers.

It won’t cover much, it won’t give you every information you need. But I do hope you will find it interesting, and that it will help you get interested and further pursue a better understanding of those subjects and the various myths that surround them!

Oh and don’t be scared about the first question ! Every bit of explanation is in the answers…

Continue reading Spring break hot tech quiz