In investment, as with all economic decisions, we must often pick between hopes and probabilities. The asset management industry uses this to trick us, here is how.

Recently, my older son told me a joke. It was simple and naive. It seemed innocent. It was not.

Toto the boy is playing cards with his grand-mother. After a few turns when he keeps winning, he is busted cheating by his grandmother.

– You are cheating Toto !

– Indeed I am !

– This is unacceptable ! Do you know what happens to cheaters in real life Toto ! ?

– Ummm yes… they win !

This simple joke, albeit deeply cynical, is actually pretty representative of what sadly happens in the grown-up world, on a regular basis. Cheaters often win. Misrepresentation often win. And even liars, often win.

In my very specific field, investment, this behavior is actually widespread, consciously or not. Part of the industry is, with very different degrees of awareness and gravity, “cheating” to win the money game…

How ?

They are selling investors hopes of higher returns, hopes of protection, hopes of stability, despite very adverse probabilities. They are selling emotions because they sell a lot better, and allow them to include higher fees.

Indeed fees are a 100% sure thing, you will pay them and they will affect probabilities negatively. Therefore if you want them high, you have to focus the investors attention elsewhere.

…and they often get away very well with it.

2 questions therefore :

How are they leading us to decide irrationally, against the most basic odds ?

How are they still in business doing so ?

Using boredom

Finance is boring. Not doubt about it.

Apart from us financial nerds who look at balance sheets with affection and discuss about compounded interests over lunch and twitter, the general population does’nt really care about finance. It is like taking out the garbage. It is absolutely necessary, but god this is not interesting.

The less work a lot of us can put in it the better. Life is too shot to take time choosing mutual funds or compounding interest rates.

And that is the all point : “I want this to be done, it is important, but I don’t really care how. I trust you“.

And that is it. You bored yourself out of rationality. You might end up with an honest advisor that will indeed choose according to odds, and evidence, or…

…with an advisor/asset manager trying to drive you into forgetting about probabilities. They will overwhelm you with charts, data, 10-page long analysis and studies and talk about each investment in de-eee-eee-tail. They will pour on you quarterly letters and reports. This is the strategy. They are selling you the hope that everything will be allright without any effort on your side.

Probabilities don’t go this way. And a little attention (did I say “work”) is needed to ensure that the odds are actually on your side.

Using fear

Very often advisors/asset managers keep the possibility to reallocate our investment portfolios to cash “in case of dire market emergency”. This is a very attractive promise : “This way we will be able to handily dodge the most dramatic events, and you will never have to suffer the harsh pain of being a financial loser”…

The thing is. The math does not add up.

Imagine you own a portfolio following blindly and entirely the European equity market (with a single Euro Stoxx 50 index fund). This index had for the last 25 years an average return of +5,5% and a volatility of 18%. Your advisor tells you that for the upcoming year he is confident that you should move this portfolio to cash.

Without any hard and data-based insight, what is the pure probability for this strategy being a winner ?

Well not much I am afraid.

Without any material information that can give you an edge against all other investors, the “normal” probability that a cash portfolio will “outperform” this basic portfolio over a year is 35 %.

And this compounds over time ! If you advisor decide to do this just once every four years, your probability to overperform a buy and hold portfolio over 20 years falls to around 20%…

If your macroeconomic science, analysis and intuition allows you to beat those very negative odds you are lucky. I cannot, and my modest opinion and experience is that no one can (at least on a recurrent, “statistically significant”, basis). I urge you to remember this excellent quote about markets and predictions from the economist Paul Samuelson :

The stock market has predicted nine of the past five recessions.

Which was later expanded with :

… but sadly none of them at the right time.

Predictions on economy and markets are hard, damn hard.

The point is, in this case, you are buying ( or sold by your advisor ) hope, or relief against the fear of losing, not probabilities. It might work once, but this is unnecessary risky, this is irrational, and it will backfire, some day. At the end maths will prevail and the investor will be poorer.

Many investing strategies, including a lot of option based products, rely also on this. You buy peace of mind. But you have to understand how much it will cost you in return, everything has a price, and the price is often lower probabilities of winning.

Using greed

People selling us hope of a very high return in exchange of a small price are using our greed.

“Look for a very small amount you can buy the chance of earning a massive return ! What a deal ! Seriously I don’t know why I am telling you that I should keep it for myself.”

The non-investment textbook example of using greed to profit is of course… national lotteries. Lottery tickets are sold for a price that is way higher than the average gain, the “mean return”, that the buyer can expect. Selling them on a very large number of people insures profitability for the seller (the state usually).

Casinos of course work the very same way.

I already wrote about it in this post. Structured products are using this all the time. They are for a lot of them promoting a high and constant return, in exchange of the hidden possibility of losing big with a low probability. “You will earn 6% a year !! (and please do not watch the legal footnotes in font size 4 which explain that on average, mathematically, you will eventually lose from this strategy)”.

The thing is those probabilities of markets plummeting are actually high, higher than they tell you. And fees are amazingly high too and very well hidden.

The way a financial salesman/woman can make use of your greed is straightforward : he/she only talks about the high potential upside and “forget” about the risks, which are usually scary. In the case of structured products they also sell you products whose probabilities of winning are so hard to compute that you have no choice to trust them.

One other example it private equity. The past return of US private equity funds could in the past go up to 10% 20% or even 30% a year (for the luckiest). Yes, but the Private equity dispersion of returns among funds is MASSIVE and while you have indeed a possibility of high return (albeit not that high anymore) you also have a very high probability of losing big… And they hardly tell you that.

When explained risks are presented as “high” or “significant”. Never the way they should which is “the 25% worst performing funds in the past had an average annual return for the investor of -15%”. Annualy. That means -56% over 5 years. Are you ready for that ?

The cover up

Those methods, using different ways to make us make irrational decisions are mathematically doomed to fail on the long run. So how can they still be in business ?

To understand that you need to learn about a world famous stock brokering “marketing” strategy which is the following :

Call 100 prospects. Push hard 50 of them to sell and 50 of them to buy the very same stock (and pocket the brokering fees in the meantime with no risk whatsoever for you).

You will be right with 50 of them, who will probably cheer and continue following you.

The 50 others might too depending on you commercial skill and the various excuses you can make up at that point (“There was an unpredictable event that will NOT happen ever again”,”We are of course very right but the market did not recognized it YET”…)

So in the worst case scenario you still have at least 50 clients that are very happy with the result of their choice. They are now committed. So you do it again ! Why not. You tell 25 of the winners to buy and … the other 25 to sell.

And so on… with replacing the “lost half” every time with new prospects of course. After a few rounds you end up with die-hard supporters that have amazing track records and full trust, the others went to another broker. Bingo. You can now advertise and communicate on the amazing results you had… on those very specific lucky clients.

In a slightly more subtle way, this is what is happening in asset management, and especially in the fund industry.

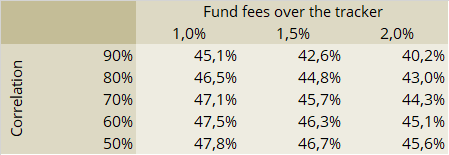

Here is a table that show the normal, no hindsight simple probability for a fund that is just randomly choosing stocks among the index horizon it is based on. The index chosen is the same as above, with a 18% volatility, and we suppose that the fund has a similar volatility (this won’t change much anyway at comparable levels).

The computed probability is “that the active fund will outperform the index fund over any 1 year period”.

What you can see in this table is that even with very high fees and absolutely no edge, your probability to outperform over one single year is still quite high, especially if you chose to differ widely from the index (i.e. low correlation).

Therefore if you can manage to convince your investors that you have an edge in the first place, and even if you don’t, and charge 2% more a year than the index fund, you still can manage more than 40% of the time to show a result after 1 year that is “supportive” of your claim.

Now this only tells us how the fund industry as a whole manage to survive bad results. 55%-60% of the funds that have bad results see their assets naturally move to the 40%-45% that had good returns. And in the meantime fees are paid on 100% of the funds. Economics.

It still does not tell us how single firms manage to survive.

And that is the second trick. Big investment companies open a lot of funds. They open new funds every year with various strategies and investment horizons. And they of course plan for some of those funds to be losers and some of those funds to be winners. The magical wand of pure randomness !

Then after a few years, they silently shut down poorly performing funds and push sales on the winning ones.

This is why when looking at past performance rational investors should always include funds that were previously closed or merged with others. Not doing so lead to a massive bias in analysis which is called “survivorship bias“.

If you only include funds that survived today, you do not take into account funds that were available and closed due to low performance. You are artificially computing higher returns than what actually happened.

Investors should also look at all the funds of the asset manager and see if there is a pattern of returns over all funds that could be significantly over-performing. Do not limit your analysis to one single fund.

So what ?

I am not trying to say that you cannot follow your hopes, your life objectives, which can and should be irrationally optimistic. But finance, boring as it is, is a mean to reach those hopes and it should be extremely rational and evidence based. You need to compute the odds or you need to fully understand how they are computed.

This is not as tough as it sounds like. But it should be done and it should lead you to exclude some investments which you don’t fully understand.

I was educated by Jesuits. And they had a quite pragmatic motto, which applies very well indeed to investing :

“Pray for what you want, sure, but work very hard too, as it might be helpful, who knows…”

Concernant la blague de Toto: quand a-t-on besoin de prendre Toto la main dans le sac en train de tricher et quand peut on juste considérer qu’il gagne trop souvent pour être honnête et qu’il doit y avoir anguille sous roche? Si l’on joue à pile ou face, à la roulette, aux petits chevaux, au backgammon, à pierre-feuille-ciseaux, au poker, aux échecs…(Cf Markopolos sur Madoff)

Il y a toutefois en asset management quelques triches légales, notamment autour des événements: IPOs, dividendes payés en actions, “optimisation” fiscale…mal pris en compte par les indices net total return. Et bien sûr les différentes variantes de biais du suvivant!

Bonne fin de journée

Bonjour Mark,

Je suis d’accord avec toi concernant les “signaux négatifs” à observer sur certains acteurs, sans avoir à les prendre la main dans le sac.

Je pense ici tout particulièrement à certains fonds, dont l’évolution est si décorrelée de leur univers d’investissement que l’ont peut se demander si ils n’ont pas recours, sans le dire, à des statégies optionnelles. Juste un exemple parmi d’autres.

Pertinent et Rafraîchissant sur de nombreux points

Quelques désaccords sur d’autres, en particulier sur l’utilisation des émotions.

Il ne faut jamais perdre de vue que la fonction d’utilité dans la gestion privée n’est pas (seulement) la performance.

Même si je n’ai jamais été un grand fan de la fonction d’utilité, que je trouve justement un peu trop mathématique pour décrire un ensemble très complexe d’émotions humaines, je suis d’accord avec vous sur le fonds : la performance est loin d’être la mesure de succès la plus adéquate pour l’investissement personnel.

Le seul vrai succès de l’investissement est de réussir à financer ses objectifs personnels.