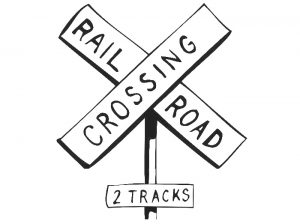

Beware! A disruption can hide another one!

This is quite a good advice, while crossing a railway, always to check for the train coming the other way, hidden by the first one. You know those kinds of signs that say: “Look the other way or you risk death and a $20 fine”.

Well this reminds me very much of the current situation of asset management. They are so deeply obsessed with the disruption train that they see, that they are not watching for the bigger, hidden train coming the other way.

A few weeks ago, I watched the internally produced interview of the head of private wealth from a large, and very conservative bank. I listened to her, unconvinced, as she boasted about the obviously large lead they had in the tech race against competitors and how their bank had clearly adapted to the “disruption”. She listed a bunch of very widespread and not-really-thrilling tools and changes, with a lack of excitement making me feel like she was actually very skeptical about it, but, “You know… PR told me to say that, it is our message, so I stick to it”.

This pictures pretty well the denial I fell asset management is now in. I talk here about private banks, asset managers, financial advisors, and even fintechs, as we will see. This denial is two-sided. First a denial of the real nature of technology (i.e. what is new and what is not). Second, a denial of the real nature of the other disruption, and in my mind way bigger, that is looming, a disruption that has actually very little to do with technology. We will come back to it.

So, what about this first denial. Here it is: they are losing control over tech and they don’t accept it or maybe realize it.

I – Technology is not what you think it is!

For a long time, the asset management industry has despised the “geeks”. Strictly kept away on both another floor and from all important decisions, very often externalized, the IT engineers were very poorly considered (and often paid) relatively to “noble” functions which were financial analysis and wealthy clients sales, golf playing, and scuba diving.

Well I have bad news for them. This is going slowly the other way around. The “geeks” are getting more and more power and from a point were finance externalized IT we are slowly going to a point were “IT” will externalize finance (and is allready…).

And let’s be clear: creating a website is not “technology”. Even a nice one, properly designed and functional, is not. It is good marketing though. Anyone with a decent web design budget can do it so there is no real tech lead possible in it.

They are confusing marketing and technology.

A real technology is based on R&D, hard, long and expensive R&D, which led to a defendable edge that cannot be copied by the first business school student who wants to create its startup. And this applies to asset management too. Designing a nice online banking or even roboadvisory website does not dig any real tech moat, sorry.

But sweating and suffering to design a real artificial intelligence engine able to assist or even (maybe) replace financial advisors does. It is very hard and long to create, requires high-priced engineers and do creates long term value.

Another real possible moat would be a complete and properly negotiated (no scraping!) multi-banks and multi-accounts aggregation service. Both of those two advances are potentially very useful and very hard to implement. They are what I am hoping as for finance-related technologies.

But private banks and asset manager’s executives seem not to understand that, delaying real investment in tech, being often cheap when they finally do it, and believing that adopting at last the technology from ten years ago will make them leaders.

Three years ago, I agreed to meet with a French private bank. They were revamping they client private website and wanted my opinion on its UX and general functionality. The website, pretty well designed, seemed ok. So, I told them that is was. But then came the weird question: “Do you think that this will make you recommend the bank’s services?”.

“…ummm no. Of course not”. For two reasons: first you are very late on this and all serious competitor already have it, you are just barely filling up the gap here. Second and foremost: this won’t make any difference if you don’t tackle seriously the main problem you have and that has nothing to do with your website or even technology:

II – You are way too expensive and you do not really care about your client’s interests!

And there we find the second denial, the second disruption. The big one coming. Moral disruption. This is not about technology, not at all, this is about serving the client’s interests, at last, and it is coming fast and strong.

The asset management industry is organized around a lie which is that the clients interest come before the industry’s interest. No, not by any mean. The industry is selling products and they have huge margins on them that do not depend on the client actually profiting from the service.

They hide those large fees in a variety of ways with the main one being active mutual funds. When it goes wrong clients are made to think the bad performance of the funds were due to “unforeseeable and unique” market conditions (that’s what the banker said right?) but never because of the 1%-3% yearly fees they seized in the meantime.

Insurance companies and banks hire “independent financial advisors” and pay them a big upfront, then annual inducements according to the recurring margin they “produce” (which mean they are incentivized to sell the high fee funds, not the good ones).

Selling more high earning products is the only way they see their business expand, the “independent” advise they give is often pure sugarcoating of this.

This amazed me recently when I learned how a very high-end and prestigious private bank was serving their clients: the ratio of inhouse salespeople to analysts is now 10 to 1. Officially. The “Private Advisors” have strong sale objectives, no freedom of any kind in their choice of asset management, which is centralized. This leads to all clients owning the same 40 % of in house active funds (highly charged as you would easily guess), 30 % of outside funds (with high inducements of course) and 30% of direct investments in large cap stocks, in order to create a narrative for the client, and distract him away from the real reasons he is underperforming.

In France this is even worse. Financial advisors who sold life insurance policies will automatically receive regular inducements as long as the contract exists… and even if they are no longer advising anything, even if they are doing nothing for the client, even twenty years later, even if they were fired by the client. Great.

But this is not going the way they would like lately, and they are not really adapting. Their response, which is basically “Let’s hire more salespeople and more good-looking ones, pressure them and please please please do not reduce the fees” is wrong, they are stubbornly clinging to the past.

Because there is a strong change going on, which affects clients before everything else: they know, or at least they are starting to know. It is now impossible for me to have a first meeting with a new client without him talking about ETFs or the greedy fee structure of banks and fund managers. Seriously it is not coming from me, but I do like it I confess, I get on their side immediately. I am not alone.

The ETF wave is of course the biggest warning call of this. Active management fees are finally decreasing and this is good. But regulators are also coming for it. Fiduciary Rule in the US, Mifid2 in Europe, the attack comes also from the political side, and they won’t stop. It might take some time to fight back the lobbies but it won’t stop. Finally, some freshly created, albeit a bit idealistic, financial advisors are now choosing the fiduciary hard way of fully aligned interest, and they are gaining steam.

Did you notice: none of those changes have anything to do with technology. They all thrive on honesty, on the finally aligned interests of the asset management innovators with their clients. This is the real gamechanger, the real potential disruption.

Okay, okay, so what? What could they do? Well I won’t surprise anyone here…

1 . Fund managers should lower their fees and introduce symmetrical performance ones (as Fidelity just announced). They should also increase the transparence of their funds and the stability of their strategy, no more black boxes. They have to limit their transaction costs, no more “salad-drying” funds for fees. They should stop giving inducements and rely on skill and data backed rationales to sell. They should sell stable long-term investment strategies, not short-term overperformance (which almost never realizes).

2 . Financial advisors should refuse those inducements if they are not already, and be paid directly by clients. They should stop selling products to move to service-only, in a buy-side manner. They must start to tell the truth to clients, the real truth, which is sometime that they should just buy two ETFs and hold them for 10 years, but that will need discipline with which they can help. They must also find a way to be paid according to their actual work and performance.

3 . Banks should obviously stop selling mediocre/expensive financials products in order to increase earnings on unsuspicious clients. They should at last strictly seperate any client advisory from asset management. Both should be competitive, separately. They should stop creating “for free” overcomplicated fiscal structures and products with the hidden objective of locking up their clients’ money inside a highly charged and illiquid vehicle.

4 . Finally, roboadvisors should focus on the real technological innovations and stop buddying with banks and asset managers which always try to pull them back to the old model. Work on AI, aggregation and keep up the good work of promoting simple, and low-fee strategies.

At the end asset managers, advisors and banks will have to finally admit this very simple truth:

They were overpaid, and this might be over.

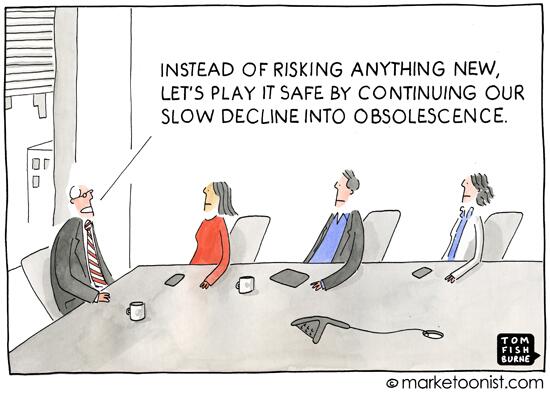

The smartest will understand that and adapt, the others will slowly but surely be “disrupted” as this great cartoon sums up very well: