How sound investing can help you mercilessly crush your kids at board games.

Once again my kids lead me into thinking at investment in a very uncommon way.

I was playing, a few weeks ago, Monopoly with my 8 years old son. It is amazing how this game still lives on. I was not planning on any preconceived strategy neither grand life lessons to my son. I was just playing. Relaxed. Cool.

But I am a nerd, and while I did not really cared to win, I did amuse myself in trying to “master” the game. To be able to win or lose if I wanted to (the later been useful as a parent). So I started over-rationalizing things. Planning and computing odds.

And it stunned me all the sudden.

All the sound investing principles I profess to my clients and use for myself are actually quite useful in this game too ! Sweet.

So let’s try to apply them, and master monopoly !

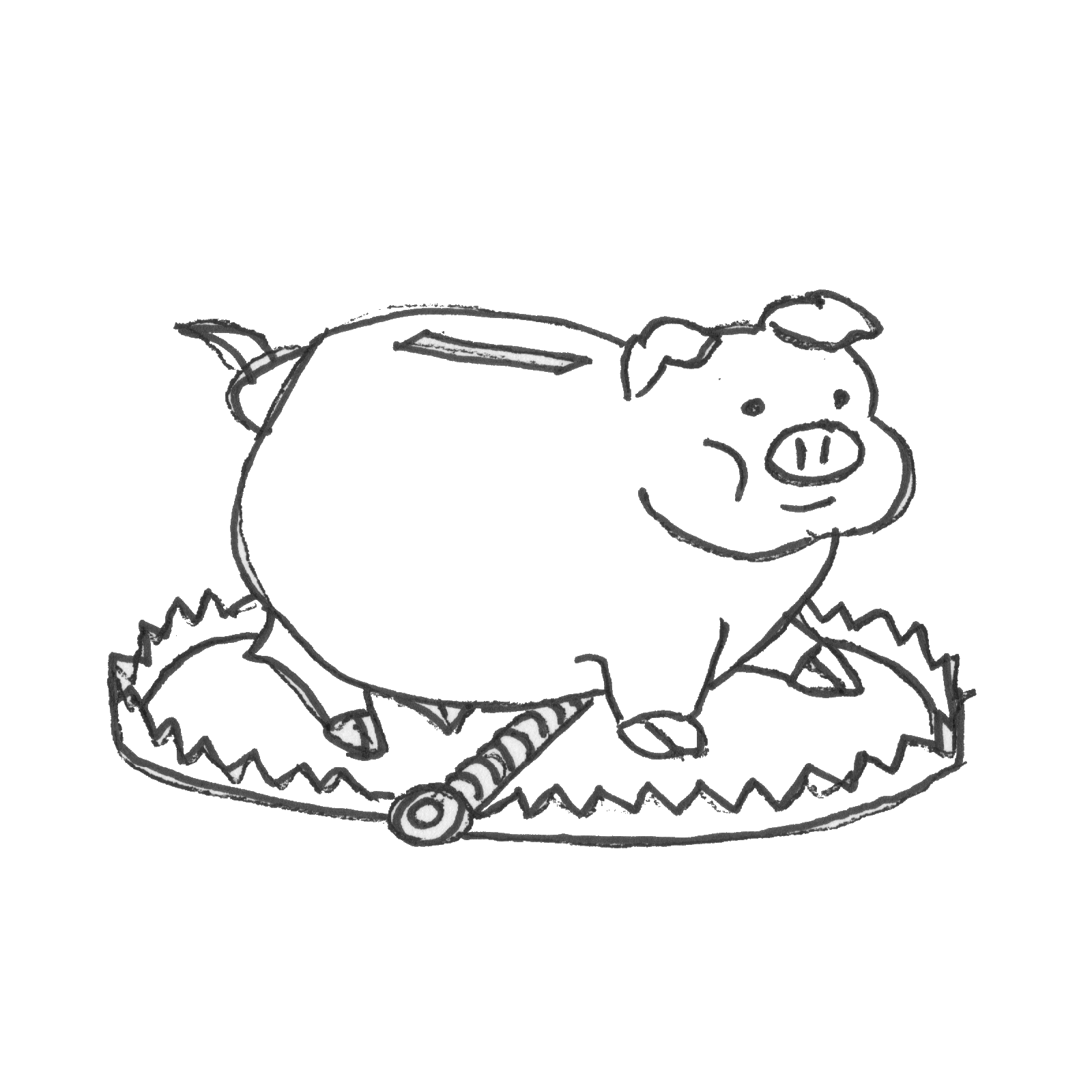

I am always amazed by the success met by dishonest financial “advisors” ( brokers would be more appropriate), private bankers and insurers representatives in selling what could be considered very low quality, even toxic investments. Those products are obviously and ultimately designed in the sole purpose of earning the largest margin for their sellers with very little or even negative interest for their buyer. How is this even possible ? Clients are not stupid, their are prudent and educated people, with professional and investment experience, and well-aware of the inner motivation of those salespeople. So why ?

I am always amazed by the success met by dishonest financial “advisors” ( brokers would be more appropriate), private bankers and insurers representatives in selling what could be considered very low quality, even toxic investments. Those products are obviously and ultimately designed in the sole purpose of earning the largest margin for their sellers with very little or even negative interest for their buyer. How is this even possible ? Clients are not stupid, their are prudent and educated people, with professional and investment experience, and well-aware of the inner motivation of those salespeople. So why ?